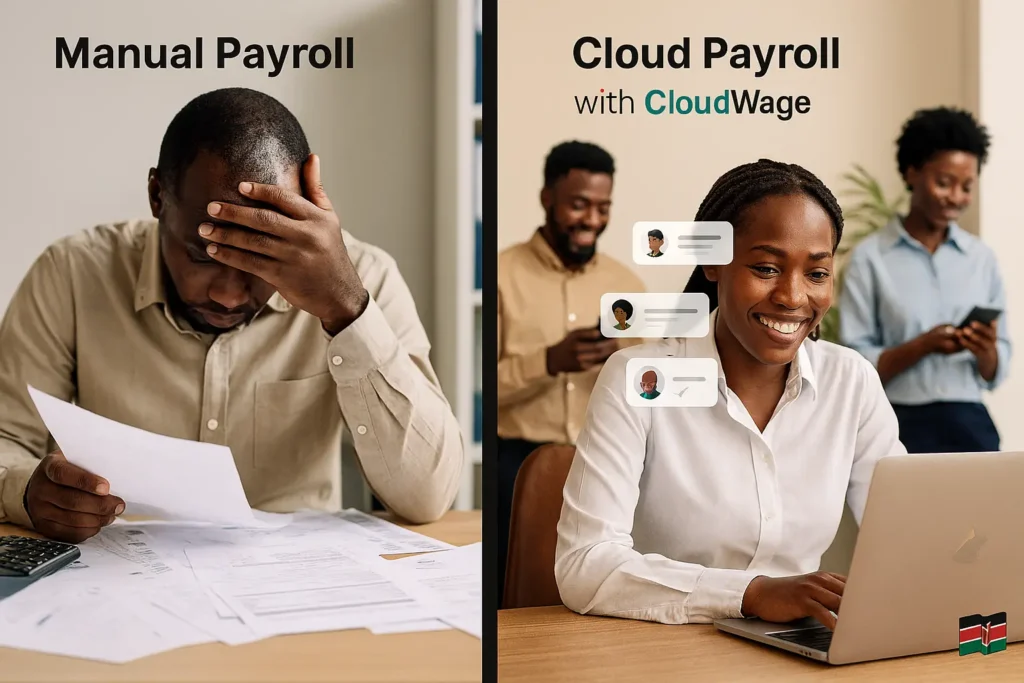

Imagine closing the month, clicking “Run Payroll,” and discovering duplicate overtime payouts because spreadsheets were merged twice. For many Kenyan SMEs, a single spreadsheet error can cost thousands of shillings and damage employee trust.

Cloud payroll software in Kenya eliminates those risks by automating calculations, centralising attendance data, and generating validated PAYE, NSSF and SHIF export files. As Kenyan businesses modernise HR, AI-powered payroll platforms like CloudWage simplify compliance and automate iTax, NSSF and SHIF processes, ensuring every deduction is accurate and on time without manual checks.

What is cloud payroll software and why it matters in Kenya

Cloud payroll software (aka an automated payroll system) is a web-hosted platform that calculates salaries, applies statutory deductions, generates payslips, and exports validated return files for government portals. In the Kenyan context, a payroll system must correctly handle PAYE (iTax), NSSF tiered contributions, the Affordable Housing Levy, and SHIF/Social Health Insurance Fund remittances and update statutory tables automatically when rates or rules change.

The Regulatory Reality: Why Manual Payroll is Riskier Than Ever in Kenya

Kenya’s payroll regulations have become more complex, and relying on manual spreadsheets now exposes businesses to compliance risks:

- PAYE Filing via iTax: Employers must file PAYE returns and remit PAYE to the Kenya Revenue Authority (KRA) through iTax by the 9th of the following month. Automated payroll software generates validated P10 and P9 files, reducing submission errors.

- NSSF Tiered Contributions: The NSSF Kenya contribution model now uses a tiered structure with phased changes (full implementation by Feb 2025). Payroll systems must accurately calculate these contributions to prevent underpayments.

- Social Health Insurance (SHIF): The transition from NHIF to the Social Health Authority (SHA) introduced a new remittance model (including a widely applied 2.75% SHIF deduction). With ongoing legal challenges and frequent regulatory updates, payroll systems that auto-update statutory tables are essential.

Because statutory rules evolve so quickly, manual payroll becomes a liability. Misapplied rates, missed deadlines, or incorrect forms can trigger costly penalties and back-payments, risks that automated payroll software eliminates.

9 Reasons Cloud Payroll Software in Kenya Beats Manual Payroll (with CloudWage)

Here’s why modern businesses in Kenya are moving from manual spreadsheets to cloud payroll solutions like CloudWage:

- Automatic Statutory Updates

Always stay compliant with NSSF, SHIF/SHA, the Affordable Housing Levy, and PAYE. Cloud payroll software automatically applies new rates so you don’t waste time chasing government circulars. - Accurate Payroll Calculations

Automated tax and deduction algorithms eliminate arithmetic mistakes and human copy-paste errors common in spreadsheets. - Direct iTax & Statutory Portal Integration

Generate validated P10/P9 files and upload directly to KRA iTax, fewer rejected files and less rework. - Single Source of Truth

Centralised employee records reduce duplicate entries across branches and departments, keeping payroll data clean and reliable. - Automated Payslips & Bulk Distribution

Employees receive payslips automatically via email, saving HR teams hours of manual admin. - Full Audit Trails

Every change to payroll data is logged, providing transparency for audits, compliance checks, and dispute resolution. - Multi-Branch & Multi-Currency Support

Consolidate payroll across locations or regions, and manage multi-currency operations in one system. - Enterprise-Grade Security & Role-Based Access

Control who can view, edit, or approve payroll to safeguard sensitive salary data. - Seamless Integration with HR & Attendance

CloudWage connects with TimeTrax and ERP systems, eliminating manual timesheet reconciliations.

Together, these benefits translate into fewer payroll mistakes, reduced compliance penalties and faster, smoother payroll runs for Kenyan businesses.

How Kenyan Businesses Can Transition from Manual to Cloud Payroll

Switching from spreadsheets to cloud payroll doesn’t have to be disruptive. With the right approach, you can cut payroll errors, reduce compliance risks and go live smoothly in weeks, not months. Here’s a step-by-step roadmap Kenyan SMEs can follow, powered by CloudWage, part of the AI-powered HR Genie.

- Map your current payroll process

List all pay elements, deductions and approval steps. CloudWage consultants often guide SMEs through this mapping to ensure no statutory requirement or allowance is overlooked. - Choose payroll software built for Kenya

Look for a system that supports NSSF, PAYE (via iTax), SHIF, and the Housing Levy, and that auto-updates when rates change. CloudWage is built specifically for Kenyan statutory flows. - Run a pilot branch

Start with one location and run parallel payrolls (manual vs. cloud) for a month. CloudWage supports side-by-side reconciliation so you can confirm accuracy before full rollout. - Integrate attendance and HR data

Manual timesheet entry is a major source of payroll errors. CloudWage integrates with TimeTrax and the broader AI HR Genie suite, ensuring attendance and employee data feed directly into payroll. - Train your HR and payroll teams

Even the best system fails if staff don’t know how to use it. CloudWage provides onboarding, exception reporting, and payslip validation training to help teams adapt quickly. - Go live with monitoring

Use CloudWage’s audit logs and exception reports to catch anomalies in the first three months. This monitoring ensures your business rules are faithfully replicated.

By phasing the rollout this way, businesses minimise disruption while gaining the benefits of automated compliance, faster payroll cycles, and fewer errors.

Industries Where CloudWage Payroll Delivers the Biggest Impact

While any Kenyan business can benefit from automated payroll, certain sectors see the highest ROI when moving from manual systems to CloudWage payroll software, part of the AI HR Genie:

- SMEs with multiple branches in Kenya: CloudWage consolidates payroll data across locations, cutting reconciliation and admin time.

- Retailers and restaurants: Shift work and casual employees are handled seamlessly with automated timesheet integration.

- Construction and field service companies: Variable hours and site-specific attendance feed directly into payroll through TimeTrax integration.

- NGOs and schools: Manage complex allowances, mixed contracts, and statutory compliance in one centralised system.

CloudWage’s exports and portal integrations ensure faster remittance and easier compliance filing for all these industries.

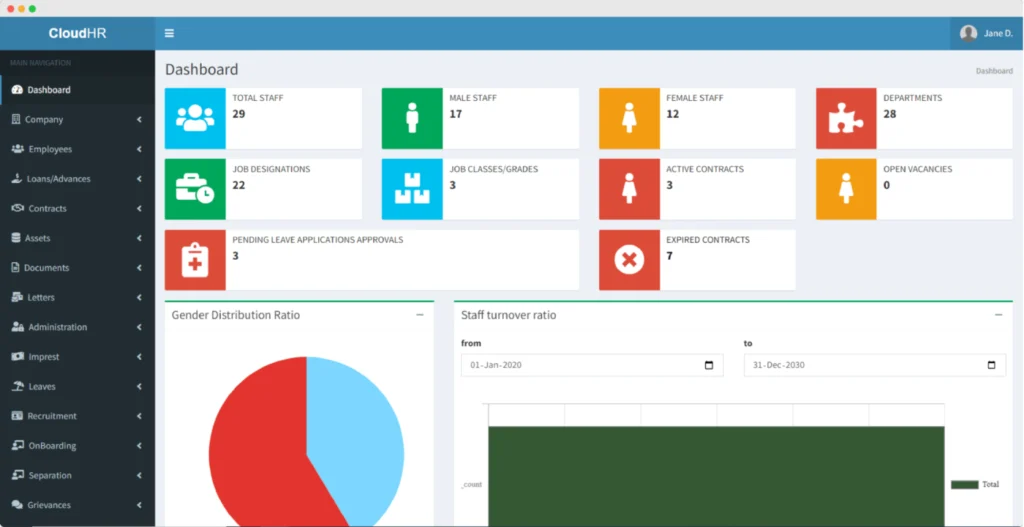

Essential Features of Cloud Payroll Software in Kenya

When evaluating a cloud payroll software system, ensure it can:

- Validate statutory deductions automatically, i.e. PAYE, NSSF (tiered), SHIF, and the Affordable Housing Levy. (Ref: NSSF Kenya)

- Export iTax-validated files (P10/P9) and NSSF submission templates to reduce rejection errors.

- Generate and bulk-distribute payslips via email to employees.

- Provide detailed audit trails and role-based approvals for accountability.

- Integrate with attendance and HR modules (e.g., biometrics, TimeTrax, HR Genie).

- Support multi-branch reporting and consolidated payroll runs for businesses operating in different locations.

If a system fails at more than one of these, it likely isn’t fit for Kenyan compliance and should be reconsidered.

What Cloud Wage AI-Powered Cloud Payroll Software offers

- AI-powered statutory validation: Instantly validates PAYE, NSSF (tiered), SHIF, and the Affordable Housing Levy, keeping deductions accurate and updated in real time. (Ref: NSSF Kenya)

- AI-optimised statutory exports: Generates iTax-validated files (P10/P9) and NSSF submission templates, with AI checking for formatting or mapping errors before submission. (Ref: Kenya Revenue Authority)

- AI-enabled payslip distribution: Automatically generates and bulk emails payslips, while AI flags unusual payroll entries (e.g., sudden allowance spikes) before release.

- Smart audit trails & approvals: Maintains detailed audit logs and role-based access, with AI monitoring for irregular changes or suspicious activity.

- AI-driven attendance & HR integration: Connects seamlessly with biometrics, TimeTrax, and HR Genie modules. AI reconciles attendance and payroll data, highlighting discrepancies in hours, shifts, or overtime.

- Intelligent multi-branch reporting: Supports consolidated payroll runs across multiple branches, with AI producing insights like branch-level variance analysis, overtime patterns, and compliance risk alerts.

With CloudWage, these AI-powered features ensure payroll is faster, more accurate, and always compliant with Kenya’s statutory environment.

FAQ about CloudWage Payroll Software

Q: Will using CloudWage stop us from being fined for late remittances?

A: No payroll system can fully immunise you from fines. However, CloudWage’s AI-powered compliance engine dramatically reduces risk by generating validated return files, auto-reminders, and error-free statutory submissions.

Q: How does CloudWage handle SHA/SHIF changes?

A: CloudWage maintains dynamic statutory tables, instantly applying new SHA/SHIF rules across all client payrolls as soon as they’re released. This ensures deductions remain compliant during regulatory transitions.

Q: We have casual and contract workers; will a cloud payroll system handle them?

A: Absolutely. CloudWage supports casual, contract, and permanent employees, including unit-based pay, shift-based work, and ad-hoc allowances.

Quick Question for You

Which payroll pain point drains the most time each month:

- Manual timesheet reconciliation

- PAYE/NSSF filing

- Duplicate payslips

- Reconciling payroll with your finance system

Reply with your top challenge, and I’ll recommend the exact CloudWage feature that solves it.

Conclusion & Next Step

Manual payroll might have been enough in the past, but Kenya’s evolving compliance landscape, from NSSF tier changes to SHIF transitions and stricter iTax reporting, has made manual systems a growing risk.

That’s why more businesses are turning to intelligent payroll platforms that automate every step, from attendance syncing to compliant export generation, all while adapting to local tax laws. CloudWage handles the heavy lifting so your HR team can focus on people, not paperwork.

Ready to eliminate costly errors and take payroll off your worry list? Request a free demo and we’ll simulate a payroll run tailored to your business, with no strings attached.

To learn more about Kenya’s payroll compliance landscape, explore our payroll guide and compliance tips.

Comments (2)

Top Payroll Challenges in Kenya 2025 and How to Solve Them

September 23, 2025[…] As more companies discover, the answer often lies in smarter systems and future-ready tools like cloud payroll software. Let’s […]

How to Prepare Payroll in Kenya: 2025 Guide + Checklist

September 29, 2025[…] why of switching to cloud payroll first (the business case and benefits), see our pillar post: Why Kenyan businesses are switching to cloud payroll software. For pain points and real employer problems that lead people to automate, see our cluster pieces: […]

Comments are closed.