In 2025, payroll management in Kenya is no longer just about generating pay slips; it’s about accuracy, compliance and real-time insights that empower businesses to grow. As regulations evolve and organisations embrace digital transformation, choosing the right payroll software in Kenya can be the difference between seamless operations and costly compliance mistakes.

Today, businesses of all sizes, from startups to large enterprises, are shifting to cloud-based payroll systems that automatically handle PAYE, NSSF, SHA and the new SHIF (previously NHIF) deductions while integrating directly with Kenya’s iTax platform. These modern solutions don’t just save time; they reduce errors, ensure compliance and give HR teams more time to focus on people rather than paperwork.

In this comprehensive 2025 payroll software comparison, we’ll explore the top payroll software and services in Kenya, compare their features, and reveal why HR Genie by SkillMind Software is quickly becoming the go-to solution for businesses looking for automation, compliance and scalability.

Choosing the Right Payroll Software in Kenya 2025

Managing payroll in Kenya has become increasingly complex. With ever-changing tax laws, statutory updates like SHIF replacing NHIF, and strict penalties for late or inaccurate remittances, relying on manual payroll processes or outdated systems is no longer sustainable.

The best payroll software doesn’t just process salaries, it ensures that your business remains compliant with the Kenya Revenue Authority (KRA), NSSF and SHIF requirements without constant manual intervention. It automates calculations, generates accurate pay slips and securely stores data in compliance with the Data Protection Act of 2019.

Beyond compliance, a good payroll system helps small and growing businesses in Kenya build trust with their employees. On-time salary processing, transparent deductions and accessible pay slips promote employee satisfaction and reduce disputes, all while giving business owners a clear view of labor costs and performance trends.

In short, the right payroll software in Kenya protects your business from compliance risks, improves employee experience and gives you control over one of your most critical operations: people payments.

Top Payroll Systems in Kenya 2025: Feature Comparison

Choosing the best payroll software in Kenya can be overwhelming. The market is full of tools that promise automation, yet only a few truly deliver compliance, scalability and local relevance. Below is a carefully curated comparison of the leading payroll systems used by Kenyan businesses in 2025, highlighting their standout features, ideal users and what makes them different.

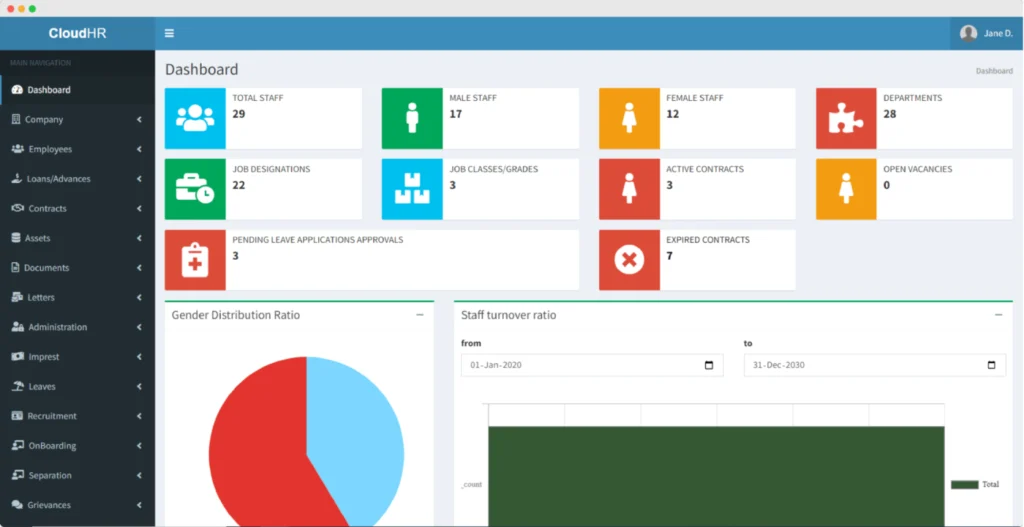

1. CloudWage by SkillMind Software (Editor’s Pick)

Best for: Small to large-sized businesses seeking flexible, compliant and AI-driven payroll automation.

Overview:

Built for the Kenyan market, CloudWage simplifies every stage of payroll from employee data management and integration with TimeTrax for time tracking and attendance to automated statutory deductions and secure pay slip generation. Unlike fixed-price competitors, SkillMind’s CloudWage offers customised pricing based on company size and structure, ensuring businesses only pay for what they need.

Key Features:

- AI-assisted reports and real-time analytics

- Automated KRA, NSSF & SHA/NHIF deductions

- Cloud-based access for remote payroll management

- Pay slip generation with bulk auto emailer

- Integration with Time Attendance and AI-powered HR Genie

Why It Stands Out:

CloudWage merges local compliance intelligence with enterprise-level capabilities, ideal for Kenyan businesses ready to move from spreadsheets to smarter, adaptable systems.

2. FaidiHR

Best for: Businesses looking for an integrated HR and payroll platform with a user-friendly UI.

Highlights:

- Web-based platform with HR and payroll management tools

- Statutory reports generation

- Leave, attendance and performance management

Consider if:

You prefer an all-in-one HR suite with less focus on deep payroll customisation.

3. Wagemaster Kenya

Best for: Companies prioritising a traditional, desktop-based solution.

Highlights:

- Supports KRA, SHIF and NSSF filing

- Simple interface for local SMEs

- Direct emails for pay slips and P9a forms

Consider if:

Your operations don’t require cloud access or advanced analytics features.

4. Sage Payroll

Best for: Established enterprises requiring regional scalability.

Highlights:

- Trusted global brand with solid Kenyan market penetration

- Built-in tax compliance modules

- Cloud hosting with robust data security

Consider if:

You have a larger budget and need regional scalability rather than local customization.

5. Movetech Payroll Software

Best for: Businesses that prefer a simple and straightforward payroll system with compliance tools.

Highlights:

- Covers PAYE, NSSF, SHIF and leave management

- Provides downloadable pay slips

Consider if:

You need a no-frills solution without advanced HR integrations.

6. Aren Payroll

Best for: Accounting firms and SMEs seeking basic automation.

Highlights:

- Runs on PCs with Windows Vista or later

- Handles statutory deductions

Consider if:

Your setup doesn’t require cloud connectivity or large-scale expansion.

7. PHP Payroll (Kenya Version)

Best for: Tech-savvy users looking for open-source payroll solutions.

Highlights:

- Supports multiple countries, including Kenya

- Fully customizable with developer access

Consider if:

You have technical capacity for setup and prefer developer-level control.

Best Payroll Software in Kenya 2025: Buyer’s Guide

Payroll is not just about paying employees, it’s about maintaining compliance, accuracy and trust. With so many software options available in Kenya, how do you know which one truly fits your business needs?

Here’s a simple, 5-step framework to help you choose the right payroll solution for your organization in 2025.

1. Understand Your Business Size and Needs

The first step is clarity. A small business with 10 employees has very different payroll needs compared to a company managing 500+ staff.

- SMEs: Should prioritize affordability, local compliance and ease of use.

- Growing enterprises: Need scalability, integrations (like time tracking or HR modules) and advanced reporting.

Pro tip: Avoid overpaying for enterprise features you don’t yet need. Software like CloudWage adapts to your company size, giving you flexibility as you grow.

2. Check for Local Compliance Automation

The best payroll software in Kenya must handle statutory deductions automatically, including KRA PAYE, NSSF and SHIF.

A compliant system should:

- Auto-calculate monthly deductions

- Generate and export reports in accepted KRA formats

- Update instantly when tax rates or regulations change

If your payroll tool doesn’t handle these updates, you risk penalties or backdated remittances from KRA.

3. Evaluate Cloud Accessibility and Data Security

Cloud-based payroll systems are no longer a luxury, they’re a necessity.

Modern HR teams need access to payroll data anytime, anywhere. A good solution offers:

- Encrypted cloud storage (ISO 27001 or equivalent)

- Role-based access control

- Backup and restore options

This not only ensures business continuity but also compliance with the Data Protection Act (2019).

4. Consider Integration with HR and Accounting Tools

Payroll doesn’t operate in isolation. It connects directly to attendance, performance and accounting systems.

Look for software that integrates with:

- Time-tracking tools (for automatic overtime calculations)

- HR modules (for onboarding, leave and benefits)

- Accounting systems (for expense mapping)

Integration saves time, reduces double entry and ensures financial accuracy across departments.

5. Test Support, Customisation, and User Experience

Many Kenyan businesses overlook one critical aspect: customer support and adaptability.

Before purchasing, ask:

- Can the vendor tailor features to your payroll structure?

- Is local support available?

- Do they offer onboarding and training?

Solutions like CloudWage provide custom pricing and setup assistance, making adoption smoother for businesses transitioning from manual systems.

How Kenyan Businesses Simplified Payroll: A Case Study

Across Kenya’s growing business landscape, managing payroll remains one of the most time-consuming and error-prone administrative tasks, regardless of company size. To illustrate this, let’s look at two different businesses that faced similar payroll challenges but found a shared solution.

Company A, a mid-sized manufacturing firm with 120 employees, used spreadsheets and manual approvals to process monthly salaries. Every payroll cycle involved reconciling data from multiple departments; HR, accounting and operations. Errors were frequent and compliance checks with NSSF and SHIF often led to delays.

On the other hand, Company B, a small marketing agency with just 15 employees, struggled with a different issue: their outsourced accountant used a rigid software that didn’t support changing tax rules or flexible pay structures like commissions and project bonuses.

Both companies turned to cloud-based payroll systems to streamline their operations and the transformation was immediate.

Within two months, Company A reduced payroll processing time from four days to less than one, with automated statutory deductions ensuring full compliance. Their HR manager noted, “We no longer have to chase spreadsheets or second-guess reports. Everything just syncs.”

Meanwhile, Company B gained flexibility and control. The owner could now process payroll anytime, from anywhere and generate pay slips instantly. “I didn’t realise how much time I was losing every month,” they said. “Now, I can actually focus on growing the business instead of fixing payroll errors.”

These examples highlight a common theme: Kenyan businesses of all sizes are moving toward adaptable, intelligent payroll solutions that save time, reduce errors and improve compliance. It’s not about the size of your company, it’s about finding software that fits your operations, integrates easily, and grows with you.

Payroll Software in Kenya: 2025 FAQs.

1. What is the best payroll software in Kenya?

The best payroll software in Kenya depends on your business size, structure and compliance needs. However, most experts recommend choosing a cloud-based payroll solution that automates statutory deductions (NSSF, SHIF, PAYE and Housing Levy) and integrates with accounting or HR systems.

2. How does payroll software help small businesses in Kenya?

Payroll software simplifies salary processing, tax compliance and reporting, even for businesses with fewer than 20 employees. Many small businesses choose solutions like CloudWage by SkillMind Software because it’s scalable, intuitive and eliminates the need for outsourcing payroll tasks.

3. Is payroll software in Kenya compliant with government regulations?

Yes, most reputable payroll systems are updated in real-time to match Kenya Revenue Authority (KRA) requirements, NSSF, and SHIF policies. Some advanced tools, like CloudWage, even auto-generate compliant reports for faster submissions with its AI-powered capabilities.

4. What should I consider when choosing a payroll system in Kenya?

Look for:

- Local compliance support (PAYE, NSSF, SHIF)

- Scalability to grow with your company

- Employee self-service portals

- Integration with HR, leave and accounting modules like SkillMind’s AI-powered HR Genie.

- Reliable customer support

These ensure your system not only processes payroll but also improves the overall HR experience.

5. How much does payroll software cost in Kenya?

Pricing varies depending on features, company size, and customisation. SkillMind Software, for instance, offers flexible pricing models tailored to each organisation, ensuring you pay only for what you need. Request a demo to find the solutions that fit your organisation.

6. Can payroll software handle remote or multi-branch employees?

Yes, modern payroll tools are designed for distributed teams. Whether your employees work in Nairobi, Eldoret or remotely, cloud-based payroll systems centralise all data in one secure dashboard.

Simplify Payroll in Kenya with SkillMind Software

Payroll management in Kenya has evolved from spreadsheets and manual errors to intelligent, cloud-powered automation. Businesses, from startups to established enterprises now understand that efficient payroll isn’t just about paying salaries. It’s about compliance, data accuracy and business agility.

Choosing the right payroll software means choosing growth without friction. It means your HR team focuses on people, not paperwork and your business stays ahead of compliance updates effortlessly.

Whether you’re running a small business, a mid-sized company, or a multi-branch enterprise, the next step is finding a solution that grows with you not against you.

That’s where SkillMind’s CloudWage comes in.

Built and optimized for the Kenyan business environment, HR Genie combines payroll, compliance automation and HR intelligence in one secure platform, tailored to your unique structure and budget.

Ready to Simplify Payroll and Compliance?

- Streamline salary processing

- Automate PAYE, NSSF, SHIF and Housing Levy.

- Get real-time reports and analytics

- Enjoy flexible pricing based on your business size

Book a Demo with SkillMind Software and discover why more Kenyan businesses are choosing CloudWage as their trusted payroll solution for 2025 and beyond.

Comment (1)

Best Cloud-Based Payroll Software Kenya| CloudWage

October 8, 2025[…] your current payroll processList all pay elements, deductions and approval steps. CloudWage consultants often guide SMEs through this mapping to ensure no statutory requirement or allowance […]

Comments are closed.